Securities are a special form of property (capital property) and include stocks, bonds and mutual funds.

When securities are donated directly to Mackenzie Health Foundation, the capital gains tax is eliminated. You will receive a Charitable Tax Receipt based on the fair market value of the gift as of the closing price on the day the securities are received by the Foundation.

Note: Your gift will not qualify for the elimination of the capital gains tax if you sell the shares and donate the cash to the Foundation. In order to benefit from the tax savings on the capital gains the shares must be transferred intact.

To transfer securities, please follow the two easy steps below:

- Complete the form below and send it to your broker or financial advisor. Your broker will be able to provide you with certain information including the CUSIP and FINS numbers.

- Once the form is complete, your broker should send a copy of the form to Scotia Wealth.

Related Pages

From cardiac nightmare to recovery miracle: David's incredible story

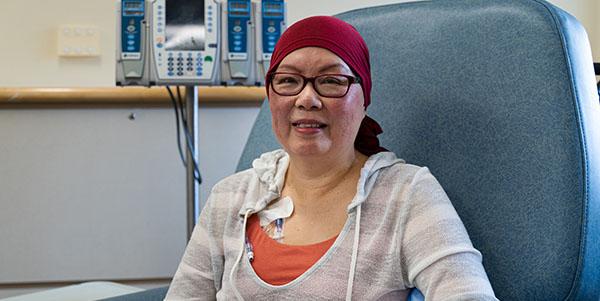

The mammogram that changed everything – The journey of Sharon, a breast cancer patient

Dr. Bill Butler Promotes Culture of Generosity in Retirement